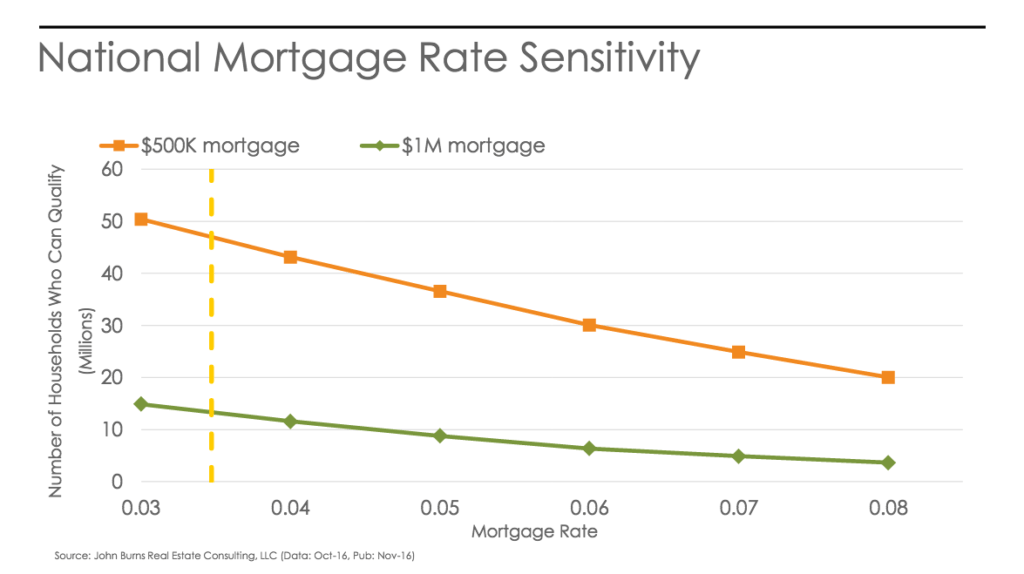

And muted inflation means central banks will approach quantitative tightening gradually and carefully, favouring a prolonged low rate environment.Ī continued benign outlook for inflation is undoubtedly a positive for markets.

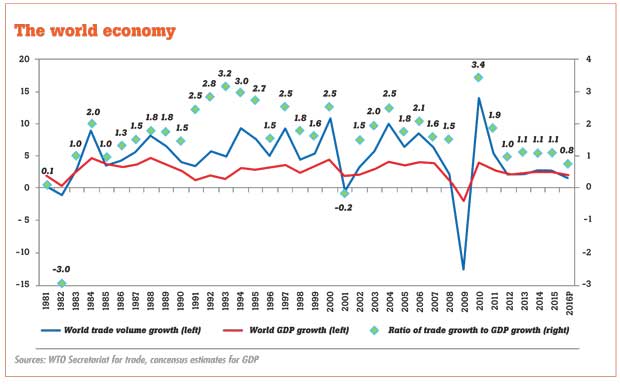

Broader and structural long-term trends including technology, automation and globalization are levers for both increased labour productivity (on the output side) and falling rates of inflation (at least outside the US).

#Goldilocks economy 2017 drivers

This set of dynamics has helped fuel synchronised global growth in both developed and developing economies, in turn supporting asset prices and keeping volatility at record lows.Įconomists point to several drivers that could further sustain and extend this global growth momentum. The current environment serves up a well-balanced economic cocktail that supports the notion of the self-reinforcing, Goldilocks economy – economic growth, moderate-to-low levels of inflation and post-crisis monetary stimulus. “Would I say there will never, ever be another financial crisis? You know probably that would be going too far but I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will be,” Yellen said in June 2017.ĭoes Yellen’s optimistic outlook hold true a year later? This prompted former Fed President Janet Yellen to reassuringly predict last year that there will be no new financial crisis in our lifetimes. And as with the fairy tale, there are three “bears” in this real-life scenario that the Goldilocks economy needs to keep at bay.Īs the Goldilocks economy has gathered steam in the aftermath of, and recovery from, the 2008 financial crisis, the fear of an imminent economic catastrophe has correspondingly subsided. These conditions translate into high equity valuations, low bond yields and narrow credit spreads.

The term Goldilocks economy - derived from the well-known 19 th Century fairy tale Goldilocks and the Three Bears - refers to a benign set of market conditions characterized by strengthening economic activity, subdued inflation and accommodative monetary policy. The phrase fairy tale economics is usually used to describe economic policies that do not add up or bear no relation to reality.īut the current reality we find ourselves in does resemble an economic fairy tale of sorts: that of the so-called Goldilocks economy.

0 kommentar(er)

0 kommentar(er)